Personal loan is an unsecured short and medium term loan granted to Individuals immediate personal need for funds.

“SMC Finance” offers personal loan to salaried individuals with a good credit score and a verified source of income. This loan product helps individuals to borrow funds to pay for expenses as debt consolidation, medical purposes, purchase of household or electronic goods, medical treatment, children’s education or wedding, home improvement and even travel. The unsecured loan is offered to salaried individuals from ages 23 to 60 at a fixed rate of interest.

How do I pay my EMIs?

Your monthly EMI’s will be deducted from your bank account where salary is credited on a fixed date as per your NACH mandate.

Can I make part – prepayment towards my Personal Loan? Will any charge be applicable?

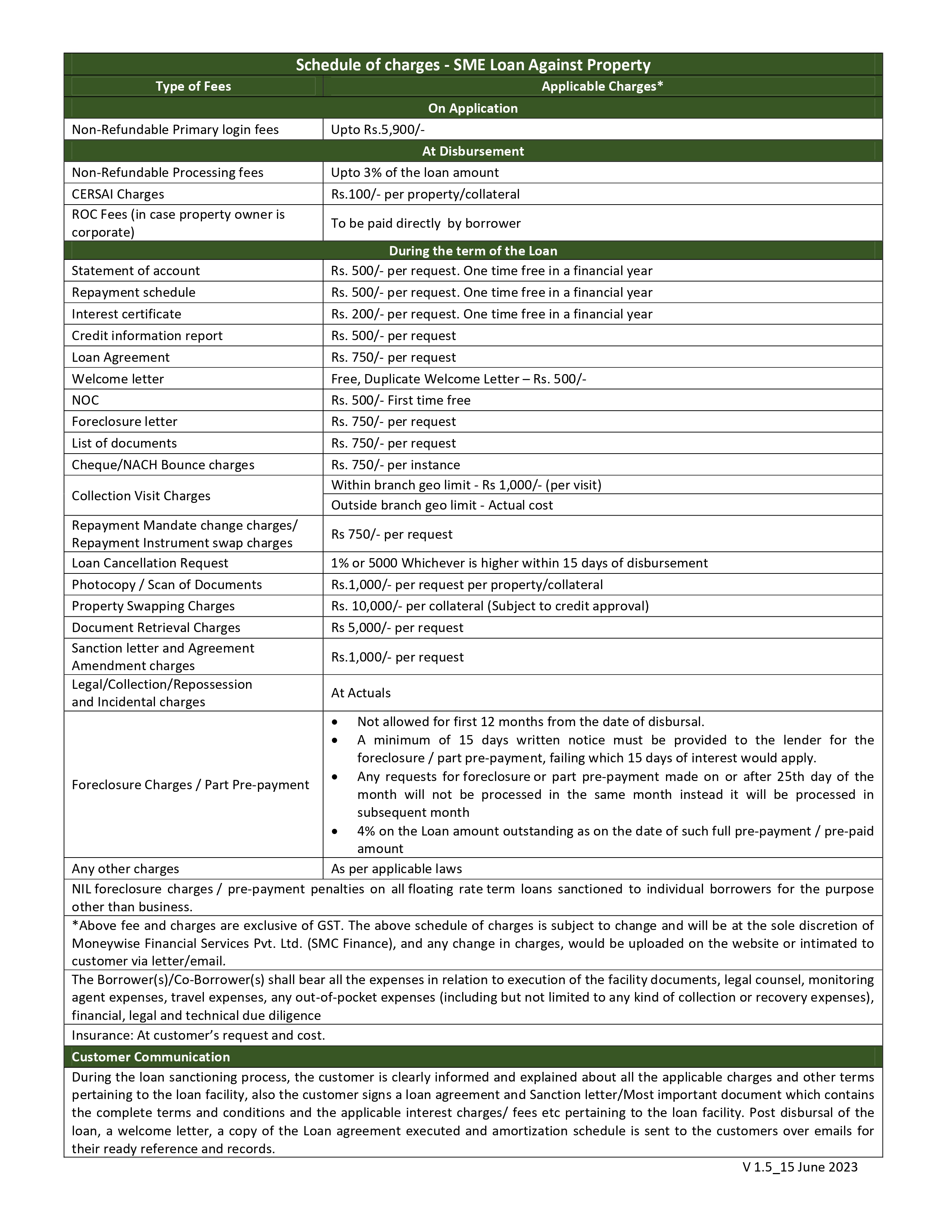

Yes, you can make a part-prepayment towards your Personal Loan. Charges will be levied as per the rates and penalties mentioned in the sanction / welcome letter.

Can I foreclose my Personal Loan? Will there be any charge for the foreclosure?

Yes, you can foreclose your Personal Loan. Before we process a foreclosure, all outstanding dues must be cleared. So we request you to first check for and clear any remaining amount that may be payable towards your Personal Loan by requesting a foreclosure statement.

Once all outstanding dues have been cleared, you need to submit a foreclosure request and we will begin processing your request.

Foreclosure charges will be levied as per the rates and penalties mentioned in your sanction / welcome letter.

What tenures are allowed for the Loan?

The Loan tenures are between 12 months to 60 months.

Can I Add a Co-applicant?

Yes, a co-applicant can be added in order to get a better credit score and avail of a larger loan amount.

15 June 2023