Riding on the customer success in the MEQ Financing, Moneywise is ready to spread its wings in the other asset classes of Asset Backed Finance which include standard equipment from Non MEQ Industries. We are looking to tie up with various OEMs, Suppliers and Dealers in the following industry to partner with us and work out compelling solutions for their end clients.

KYC Documents

List of documents required for Proprietorship

Note: Original documents are required for verification purpose only.

List of documents required for Partnership Firms

Note: Original documents are required for verification purpose only.

List of documents required for Companies

Note: Original documents are required for verification purpose only.

List of documents required for Listed Companies

Note: Original documents are required for verification purpose only.

Riding on the customer success in the MEQ Financing, Moneywise is ready to spread its wings in the other asset classes of Asset Backed Finance which include standard equipment from Non MEQ Industries. We are looking to tie up with various OEMs, Suppliers and Dealers in the following industry to partner with us and work out compelling solutions for their end clients.

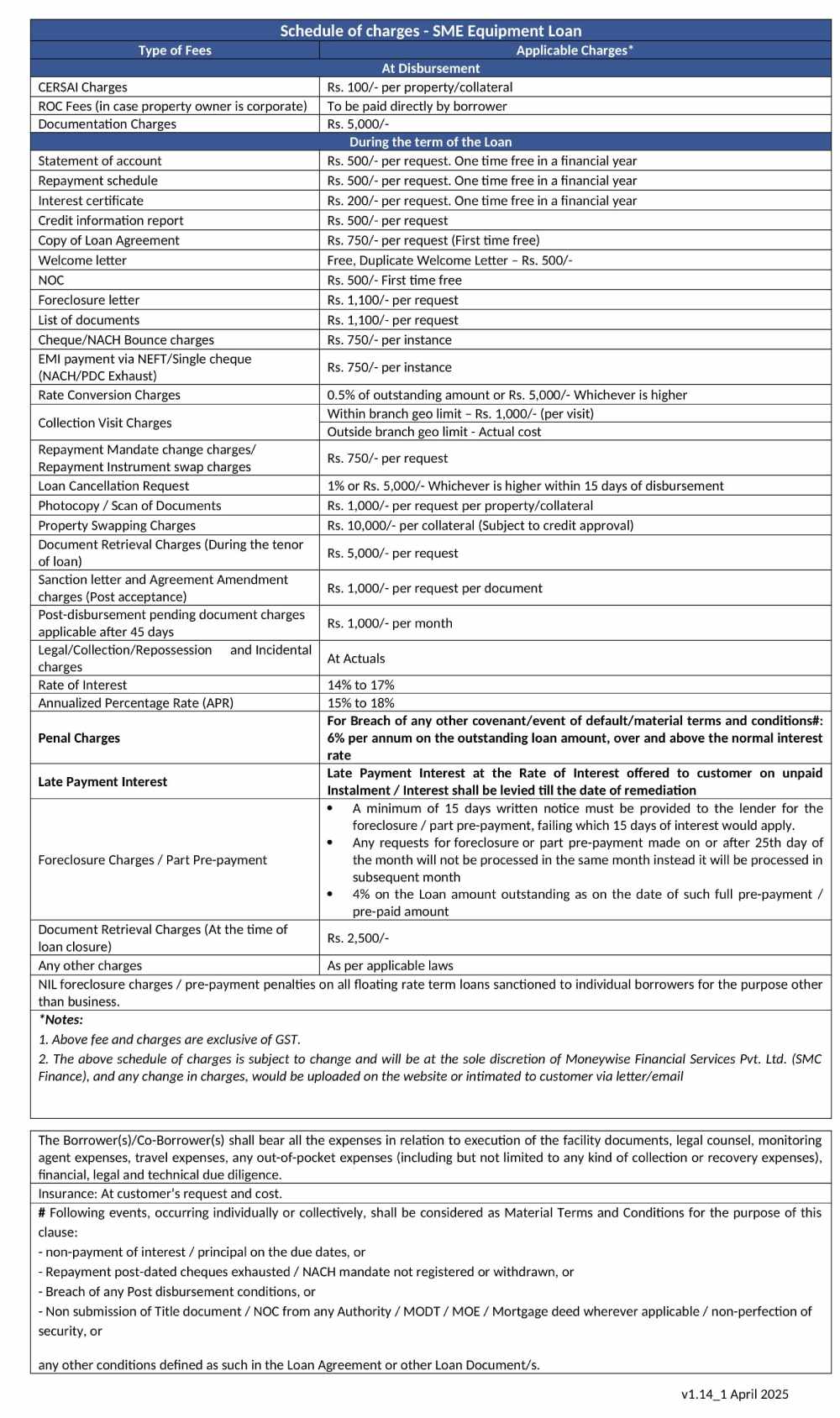

1st April 2025

KYC Documents

List of documents required for Proprietorship

Note: Original documents are required for verification purpose only.

List of documents required for Partnership Firms

Note: Original documents are required for verification purpose only.

List of documents required for Companies

Note: Original documents are required for verification purpose only.

List of documents required for Listed Companies

Note: Original documents are required for verification purpose only.

Coming Soon

Coming Soon